Media

Contact Us

- Home

- Who We Are >

- What We Do >

- Investors >

- Sustainability >

- Media

- Working for Us >

- Contact Us

Our Strategy

Driving performance through MAP

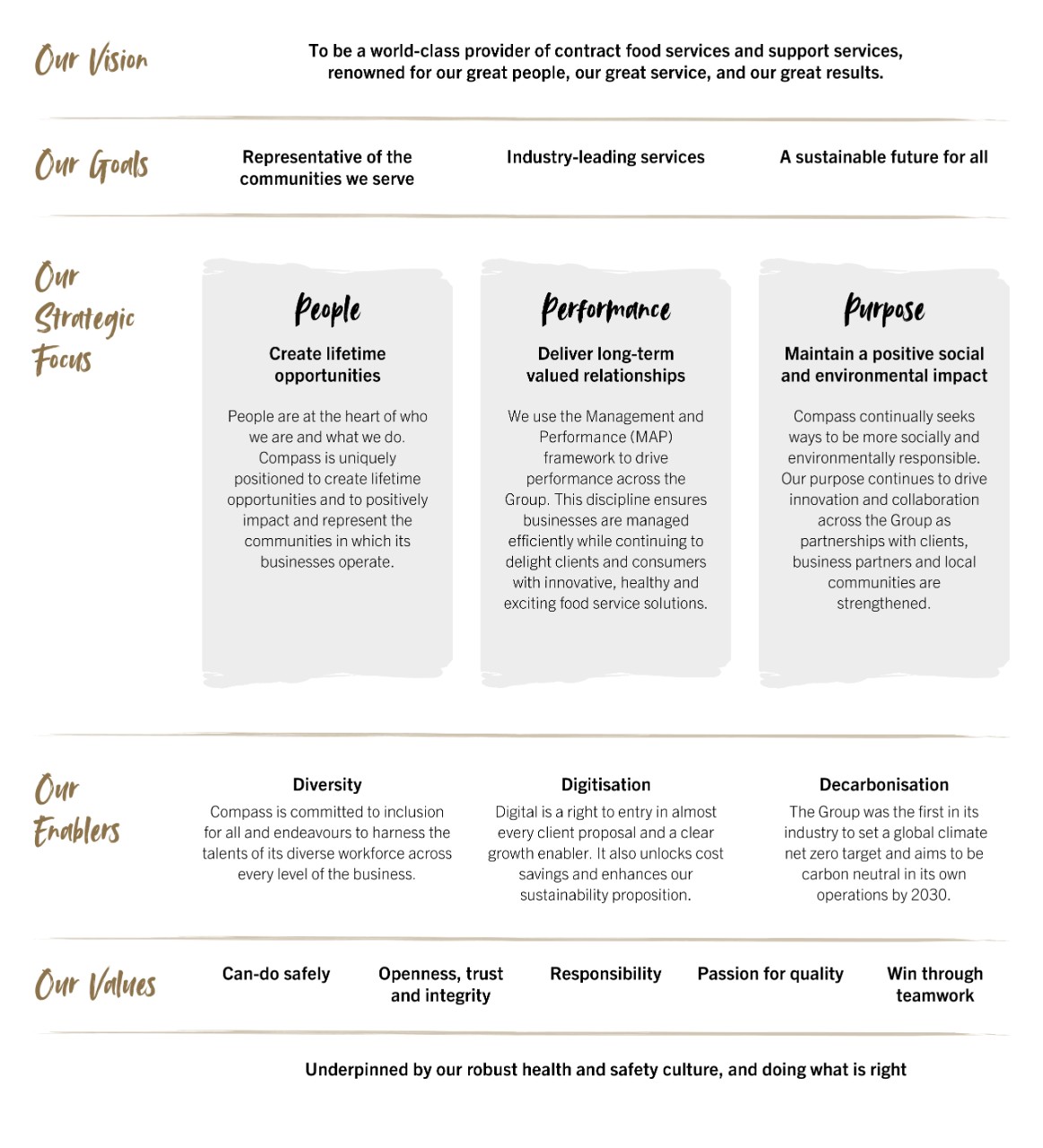

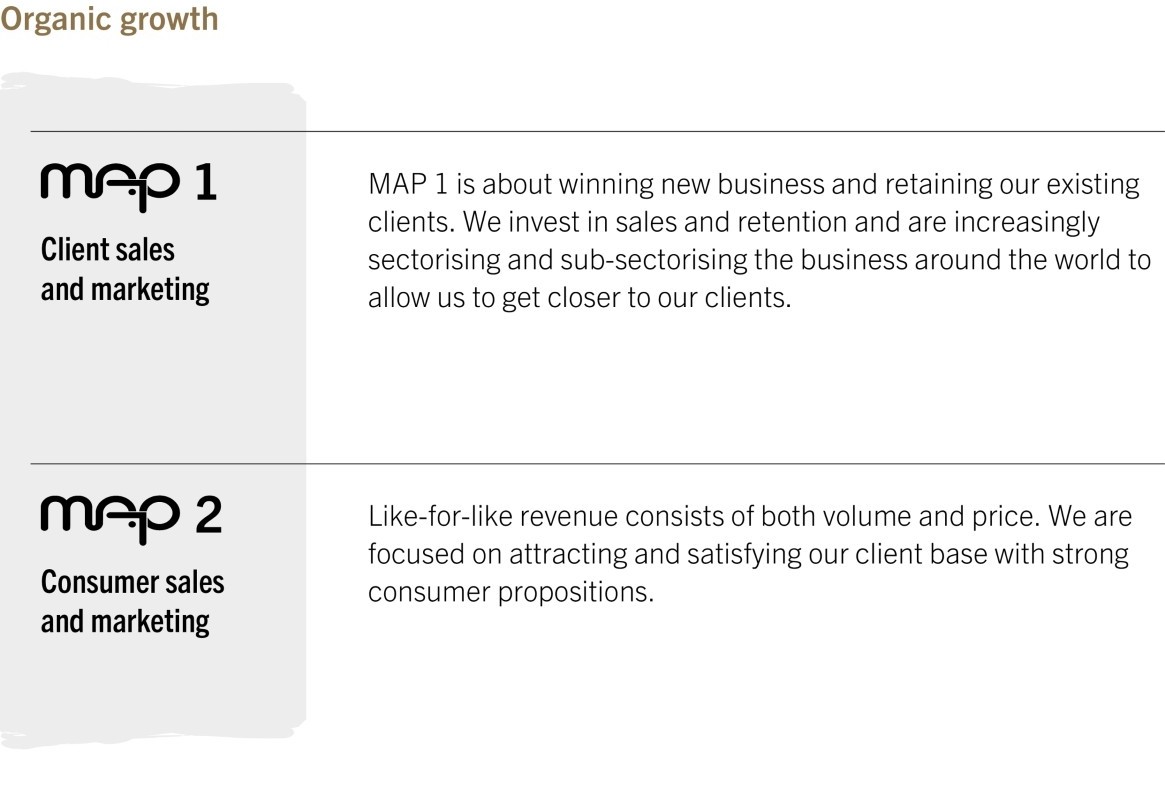

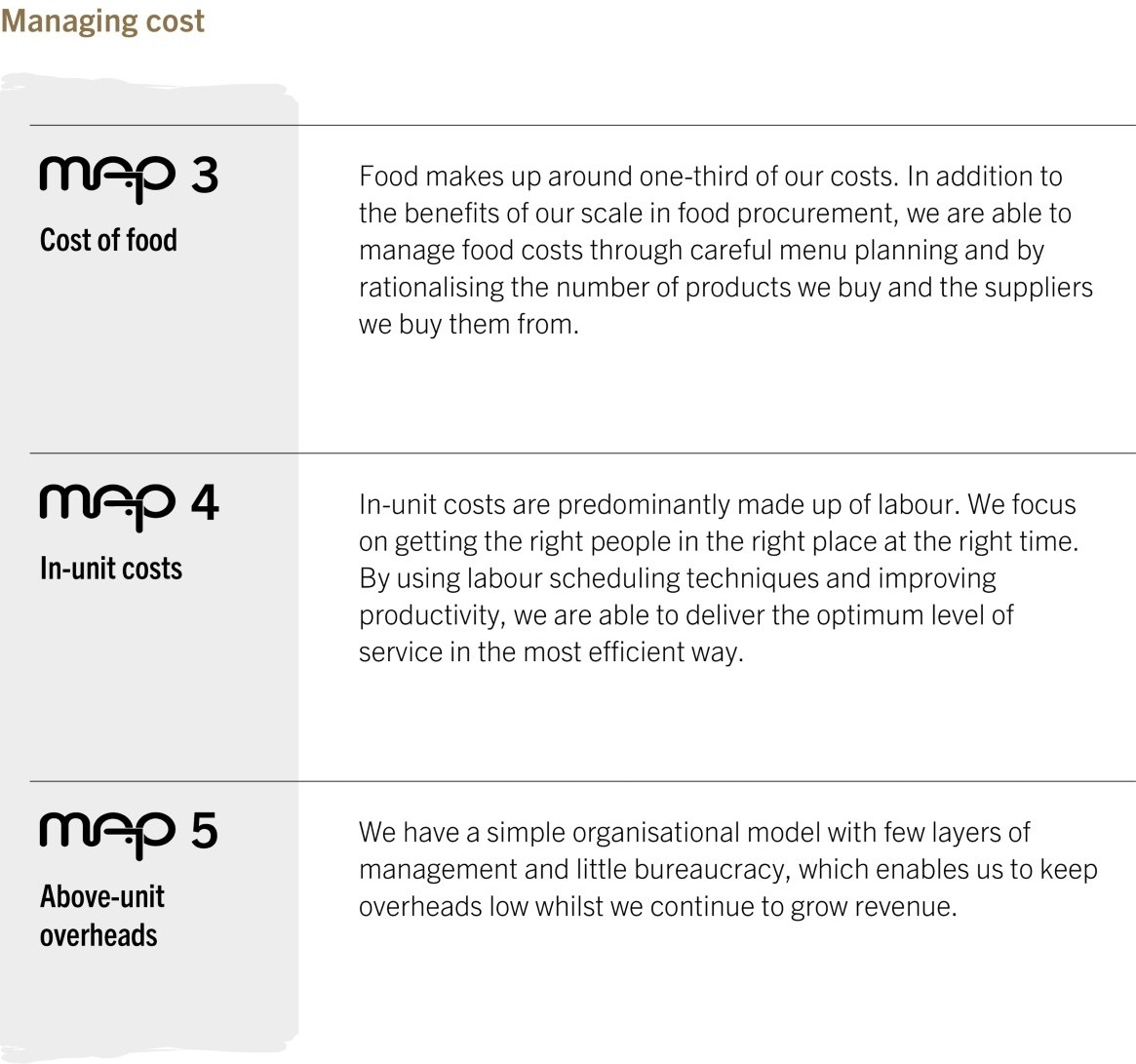

We use our Management and Performance (MAP) framework to drive performance across the business. It is a simple framework embedded in our culture, which ensures all employees are focused on meeting the following performance drivers:

Creating value for all stakeholders

Clear capital allocation

Compass is a strong cash-generating business with a clear capital allocation model. We invest both organically and through acquisitions to drive growth. Our policy is to pay around 50% of underlying earnings through an ordinary dividend, with further additional shareholder returns when appropriate.

We do this whilst maintaining a resilient balance sheet, targeting net debt to EBITDA in the range of 1x-1.5x. Consistent with this framework is the return of excess capital to shareholders through share buybacks.

Hungry for more?

© 2026 Compass Group PLC